For many in Pakistan, the money to start a company, advance their education, or improve their standard of living may depend on financial aid. With interest-free loans, the Akhuwat Loan Scheme brings a great option for needy people. If you are considering an application, for 2025, this guide will explain how an Akhuwat loan process works in clear and simple language.

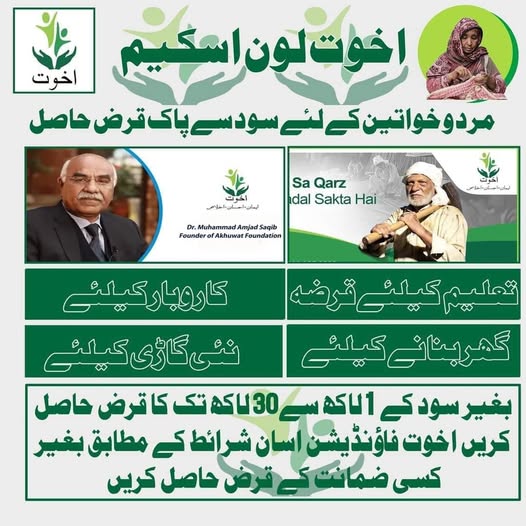

Akhuwat Loan Scheme

Non-profit Akhuwat Foundation provides interest-free microloans to small businesses and individuals. They’re more for financial freedom and financial security without threats of high interest rates.

Among many of the choices that Akhuwat offers are

- Commercial loans to entrepreneurs, whether to begin a small business or to expand a small one

- Education Loans to pursue higher studies.

- Housing loans for home renovation or building.

- Agricultural credits to help those farmers and small towns.

- Marriage and Health Loans assist with healthcare emergencies or wedding expenses to provide relief to families.

How to Apply for an Akhuwat Loan in 2025

Anyone who qualifies has a very straightforward and transparent application process. This is how you can make use of:

- Check Your Eligibility.

- Check first if you meet the basic requirements.

- You must be a Pakistani citizen.

- You must be from a low-income background.

- A guarantee might be required.

- Repayment the loan is only possible after making a strategy.

Head to the nearest Akhuwat Center

Start your application process by visiting the closest Akhuwat office. Their addresses can be found on the official Akhuwat Foundation website or you can dial their helpline.

Prepare the Required Documents

It is always better to carry these things when you visit the Akhuwat office:

- A valid CNIC (Computerized National Identity Card).

- A current utility statement for address checking.

- If you are looking for business finance, a business proposal.

- If required, guarantees information applies.

Applications & interview preparation

Once you submit your application, the Akhuwat team will discuss your information with you. In some cases, they may conduct a short interview to understand your financial requirements better.

Loan Grab & Disbursement

After accepting your application, your loan will be transferred either by check or through a bank transfer. Your repayment schedule will also be given so that your repayments do not delay and get done well in time.

What makes Akhuwat Loans preferable

No interest charges: fully interest free monetary assistance

Minimal documents and simple approvals: quick and smooth process

Minimal documents and simple approvals: quick and smooth process

Support for All offers possibilities for you whether you need a loan for personal, business, or academic purpose.

Lastly thoughts

For those seeking financial help free of interest, the Akhuwat loan program offers a fantastic chance. Apply today if you require assistance beginning a company, furthering your education, or managing domestic costs.

Visit the official Akhuwat Foundation website or contact their next location for further details. Financial stability begins for you when you first step forward very naturally.